What if I told you that doing my taxes could be less of a headache this year?

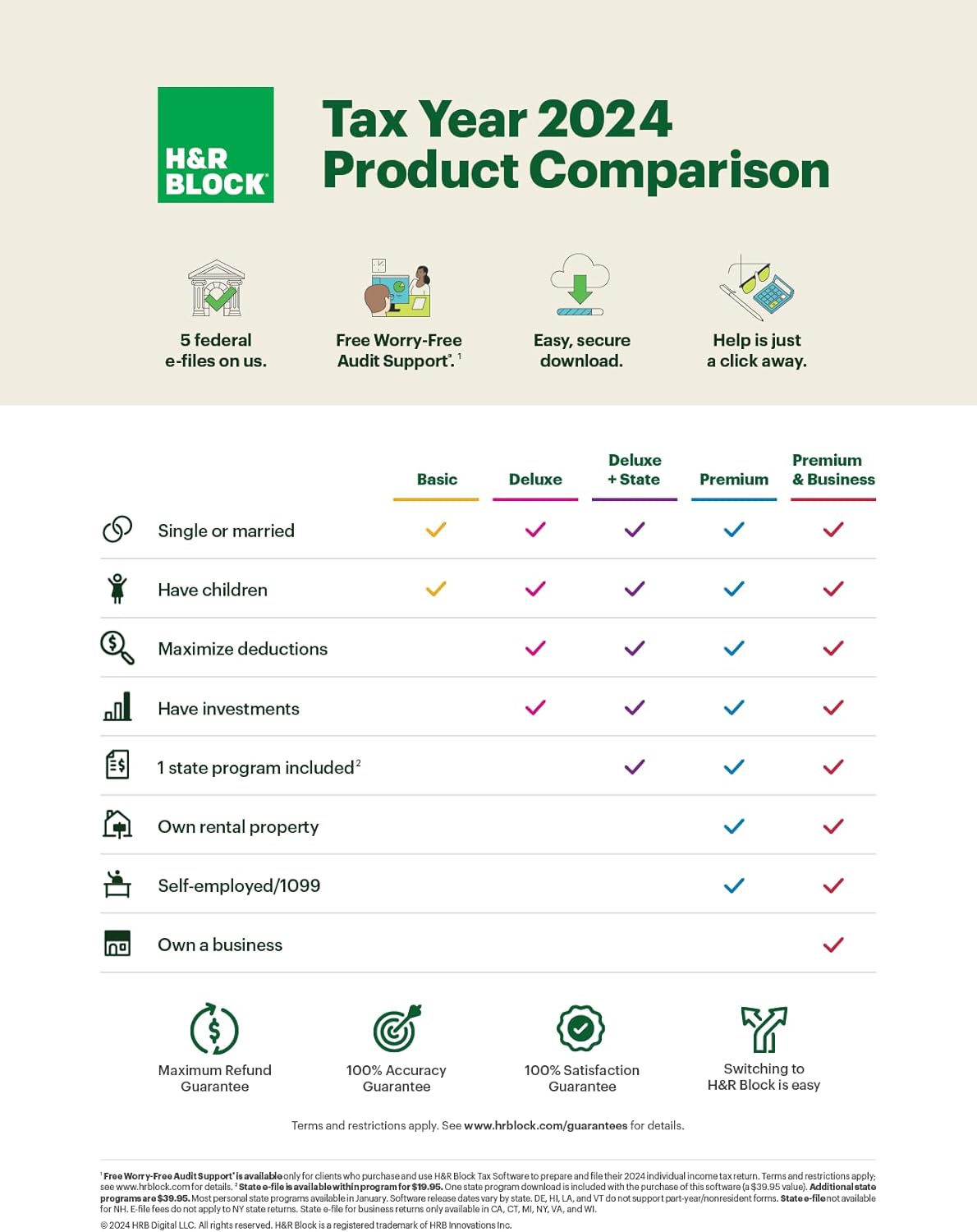

H&R Block Tax Software Deluxe + State 2024 Overview

I stumbled upon the H&R Block Tax Software Deluxe + State for 2024, and honestly, it seems like a game changer for anyone looking to get their taxes done smoothly. This software is Amazon exclusive, which is a nice perk, and offers a very appealing refund bonus offer—more on that later.

Features That Stand Out

There are some fantastic features packaged in this tax software, and I was genuinely impressed by how user-friendly it seemed. Here’s a breakdown of what it brings to the table:

| Feature | Description |

|---|---|

| Refund on Amazon Gift Card | Choosing this option gives me a 2% bonus on my refund |

| Import Capability | I can quickly import my W-2, 1099, 1098, and even previous tax returns |

| State Program | I get one state program download worth $39.95 included |

| Investment Reporting Assistance | It provides guidance on income from investments and stock options |

| Mortgage Interest Deduction Guidance | The software assists in maximizing my deductions for real estate |

| Step-by-Step Guidance | It offers a Q&A process that simplifies complicated questions |

| Accuracy Checks | The software checks for issues and assesses audit risk |

| Free Federal E-files | I’m able to file five federal e-files for free and unlimited preparation |

User Experience

When I started using the H&R Block Tax Software, I appreciated how straightforward everything felt. The interface is clean, making it easy to navigate through my tax return. It’s almost like having a conversation with a knowledgeable friend about my finances.

Refund Bonus Offer

The 2% bonus on my refund if I opt for an Amazon gift card is a fantastic incentive. Why wouldn’t I want to earn a little extra? Considering how much I usually spend on Amazon, that bonus would easily be turned into something useful.

Importing Tax Information

Why Importing Matters

One of the standout features of this software is the ability to import previous tax documents. My tax season often involves a tedious process of finding past documents. With H&R Block, I found that importing my W-2 and other forms was as easy as a few clicks.

How It Works

The software supports direct imports from TurboTax and Quicken. I didn’t realize this would be a game-changer for me until I actually tried it. I simply fed my last year’s return into the system, and it populated relevant fields without me lifting a finger.

State Program Included

The Value of State Filing

Filing taxes isn’t just about the federal return; many states require separate filings, and that can rack up additional costs. This software conveniently includes one state program download, which is a value of $39.95! Knowing that I’ve already got that covered feels like a weight lifted off my shoulders.

Adding More States

If I ever find myself needing to file for additional states, it’s comforting to know I can purchase downloads at that estimated rate. It’s just another example of how H&R Block thinks of everything when designing this product.

Investment Reporting Assistance

Handling Investment Income

As someone who has dabbled in investment income, I can confirm it can get a little overwhelming. Fortunately, the H&R Block Tax Software walks me through reporting income from various sources, including stock options and home sales.

The Details

The platform guides me through those sometimes puzzling investment forms. Having step-by-step advice is incredibly helpful when dissecting the complexities of capital gains, dividends, and all those other financial terms that used to confuse me.

Mortgage Interest Deductions

Importance of Deductions

Mortgage interest deductions can result in significant savings, and I always try to maximize this benefit. This software really shines in helping users like me figure out how to claim these deductions effectively.

Assistance and Guidance

H&R Block’s software dives into the specifics of Schedule A deductions and gives me straightforward advice on how to make the most of my real estate tax benefits. This is often a grey area for many, but the guidance provided really clarifies what I’m eligible for.

Step-by-Step Q&A Process

Making Tax Filing Interactive

What I love about H&R Block is that it’s not just a static program; it features an engaging Q&A session at various points. Instead of just filling out forms, I feel like I’m having an actual conversation that guides me through the tax process.

Addressing My Concerns

When I faced a tricky scenario about rental income, I was pleasantly surprised to find it had targeted questions that helped me clarify my situation. Having that personalized touch made a world of difference.

Accuracy Review Checks

Peace of Mind

Knowing that my return is set for potential issues is essential. The accuracy review checks help assess the potential pitfalls in my filing process in a way that feels like a safety net.

Audit Risk Assessment

The software looks for common mistakes and even assesses my audit risk, which was reassuring. I must admit that first-time filers can often feel anxious about audits, and having that in the background truly helps.

E-Filing Benefits

Submitting Quickly

Gone are the days of mailing in tax returns and waiting endlessly for feedback. With H&R Block, I have access to five free federal e-files, which means I can submit my returns quickly and efficiently.

Unlimited Preparation and Printing

Even if I mess around with my forms and have second thoughts, the unlimited preparation and printing option provides me with the freedom to double-check everything. One of the most anxiety-inducing aspects of tax season is that last-minute panic where I worry about missing something.

Final Thoughts on H&R Block Tax Software Deluxe + State 2024

After navigating through everything this product offers, I genuinely feel more equipped to tackle my taxes than I did in previous years. The features combined with user-friendly support make this tax software a fantastic choice.

Value for Money

Given all that’s included, I think I received tremendous value for my investment. The refund bonus offer and free e-filings alone pay for the software many times over. So, if someone were to ask me if it’s worth it, I’d say a resounding “yes.”

Recommendation

I find myself encouraging friends and family to give the H&R Block Tax Software a shot as tax season rolls in. It’s comforting knowing that I have a supportive platform at my disposal, especially given the complexities of filing taxes today.

Conclusion

With the H&R Block Tax Software Deluxe + State for 2024, I genuinely feel prepared for tax season. The thought of combing through stacks of paper has been replaced with a digital solution that’s efficient, comprehensive, and yes, maybe even fun. So when it comes to handling my taxes, I’m feeling pretty good about it this year!

Disclosure: As an Amazon Associate, I earn from qualifying purchases.

![See the HR Block Tax Software Deluxe + State 2024 with Refund Bonus Offer (Amazon Exclusive) Win/Mac [PC/Mac Online Code] in detail. See the HR Block Tax Software Deluxe + State 2024 with Refund Bonus Offer (Amazon Exclusive) Win/Mac [PC/Mac Online Code] in detail.](https://baymartusa.com/wp-content/uploads/2025/01/buy-now-red-5.png)

![HR Block Tax Software Deluxe + State 2024 with Refund Bonus Offer (Amazon Exclusive) Win/Mac [PC/Mac Online Code] HR Block Tax Software Deluxe + State 2024 with Refund Bonus Offer (Amazon Exclusive) Win/Mac [PC/Mac Online Code]](https://m.media-amazon.com/images/I/51+fonAXhPL._AC_SL1080_.jpg)

![HR Block Tax Software Deluxe + State 2024 with Refund Bonus Offer (Amazon Exclusive) Win/Mac [PC/Mac Online Code] HR Block Tax Software Deluxe + State 2024 with Refund Bonus Offer (Amazon Exclusive) Win/Mac [PC/Mac Online Code]](https://baymartusa.com/wp-content/uploads/2025/02/hr-block-tax-software-deluxe-state-2024-with-refund-bonus-offer-amazon-exclusive-winmac-pcmac-online-code.jpg)

![HR Block Tax Software Deluxe + State 2024 with Refund Bonus Offer (Amazon Exclusive) Win/Mac [PC/Mac Online Code] HR Block Tax Software Deluxe + State 2024 with Refund Bonus Offer (Amazon Exclusive) Win/Mac [PC/Mac Online Code]](https://baymartusa.com/wp-content/uploads/2025/02/hr-block-tax-software-deluxe-state-2024-with-refund-bonus-offer-amazon-exclusive-winmac-pcmac-online-code-1.jpg)

![HR Block Tax Software Deluxe + State 2024 with Refund Bonus Offer (Amazon Exclusive) Win/Mac [PC/Mac Online Code] HR Block Tax Software Deluxe + State 2024 with Refund Bonus Offer (Amazon Exclusive) Win/Mac [PC/Mac Online Code]](https://baymartusa.com/wp-content/uploads/2025/02/hr-block-tax-software-deluxe-state-2024-with-refund-bonus-offer-amazon-exclusive-winmac-pcmac-online-code-2.jpg)